Một Life Policy Indexed Universal là gì?

Một hợp đồng bảo hiểm liên kết chung có phí bảo hiểm linh hoạt với cả hai lựa chọn tín dụng lãi suất cố định và ghi chỉ mục.

What is an Indexed Universal Life Policy?

An Indexed Universal Life Policy (IUL) is a type of permanent life insurance policy that provides a death benefit as well as the ability to build Accumulation Value. This type of policy has the potential to earn interest based upon the performance of a index which makes this an Indexed Universal Life Insurance Policy. However, you are never invested directly in the market and your policy will never be credited a negative interest rate. This allows you to take advantage of the potential increases in the index while maintaining a level of protection in the event that the index drops below 0%.1 With an IUL policy, you have the flexibility to adjust the amount of premiums you contribute. You may even have the potential to stop contributing premiums if you accumulate enough to cover the cost to keep the policy active. If your Accumulation Value is enough, you may be able to access some of your accumulation later in life through policy loans

1 You will never be credited a negative interest rate related to a change in the index, however, due to monthly deductions to your policy, your Accumulation Value may decrease. 2 Policy Loans are subject to interest charges and can reduce the death benefit paid to beneficiaries. Outstanding policy loans may affect the policy’s death benefit, the value of the policy and possibly the length of time the policy remains in force.

How can Signature IUL be used?

To Provide for Dependents

Signature IUL is first and foremost life insurance. And life insurance, of course, provides the death benefit protection that might be vital to the well-being of loved ones. Signature IUL can help provide for dependents in the event of premature death. By paying off the mortgage as well as providing family income and educational funds, Signature IUL can help assure that children and grandchildren will have the money they need to complete elementary school, high school, and college.

Death Benefit Options:

You have the flexibility to select from three different choices for paying death benefits to your beneficiary:

• Option A (level) - Your death benefit will be the specified amount shown on the policy form or the minimum death benefit calculated under the standard guideline premium test

• Option B (Increasing) - Your death benefit will be the specified amount plus the Accumulation Value, or the minimum death benefit calculated under the standard guideline premium test

• Option C (Return of Premium) - Your death benefit will be the specified amount plus all premiums paid (including those paid for riders) less any partial surrenders made, or the minimum death benefit calculated under the standard guideline premium test

You may be able to change the death benefit option after issue. Restrictions apply:

• Option A to Option B - Can be requested any time prior to the anniversary of the Issue Date following the Insured’s attained age of 85.

• Option B to Option A - Can be requested after the Issue Date.

• Option C to Option A - Can be requested after the Issue Date.

• Option C to Option B - Not permitted at any time

• Option C- Changing to Option C after issue is not permitted.

To Provide Supplemental Retirement Income via Accumulation Value2

Dollars spent paying Signature IUL premiums can serve dual purposes because the same policy that protects loved ones can build Accumulation Value. The Signature Indexed Universal Life insurance policy’s available Accumulation Value can be used to supplement retirement through policy loans.

For Tax Deferral

Signature IUL enjoys tax deferred accumulation because no current income tax is due on Accumulation Value in a life insurance policy. Life insurance offers one of the few opportunities—outside of qualified plans—that individuals have to enjoy tax deferred accumulation over a lifetime.3

Interest Crediting

OPPORTUNITY FOR ACCUMULATION

Signature Indexed Universal Life Insurance was designed to take advantage of the opportunity to increase the Accumulation Value in the policy without exposing the Accumulation Value to the significantly greater risks associated with directly participating in an index or any equities.

Signature IUL has five types of Interest Crediting Strategies: A Fixed Account and multiple Indexed Interest Crediting Strategies. When a policy is applied for, allocations are chosen for the different strategies.

A percentage of premiums may be allocated to any of the available interest crediting strategies.

When your premiums are paid, they are deposited into what is called a Sweep Account. This is a holding account where net premiums1 will be held until the monthly sweep date, at which time premiums will be “swept” into the Fixed Account or Indexed Strategy as you have allocated. Interest is credited to money in the Sweep Account at the same rate as the Fixed Account.

Fixed Interest Crediting Strategy

The fixed account will earn interest at a rate periodically determined by the company. Interest is calculated using a compound method assuming a 365 day year. The rate credited to the fixed account will never be less than the minimum guaranteed interest rate for the policy.

Interest is credited at an annual effective interest rate. Any surrenders will reduce the amount of interest credited to your policy.

There is no minimum premium allocation associated with the Fixed Account. You may allocate any percentage of the Sweep Account Transfer amount to the Fixed Account. However, the combined total percentages allocated to the Fixed Account and Indexed Strategies cannot exceed 100%.

The Indexed Element

An “index” is a financial measure of movement in the market. Signature Indexed Universal Life uses the changes in the S&P 500® Index to determine interest earnings for indexed crediting strategies.

Interest Credited Based Upon Movement of an Index

The key to indexing is that no money is directly in the underlying index, the stock market or any equity. Instead, the movements of the index from one period to another are tracked and used as the basis for crediting interest.

The result? The potential for a higher credited interest rate with a built-in zero percent floor for an interest rate based upon the performance of an index. From policy month to policy month your Accumulation Value may decrease due to your monthly deduction regardless of the interest rate credited.

This hypothetical example is intended solely for illustrative purposes and is not an indication of past or future performance of the Signature IUL product. The published S&P 500® Index does not reflect dividends paid on the stocks underlying the Index.

Indexed Interest Crediting Strategies on Signature IUL

Signature IUL uses Indexed Strategies to credit interest earnings based on the performance of the S&P 500® Index. The Indexed Interest Crediting Strategies use annual reset Point-to-Point strategies to determine the interest, if any, to be credited to the Indexed Strategies.

There is not one particular interest crediting strategy that will deliver the most interest under all economic conditions. The interest credited excludes any dividends generated by the specific stocks in the S&P 500® Index because your premium payments are not invested in the S&P 500 Index. The indexed strategies provide the opportunity for potential increase in the interest earnings that may be greater than those in the Fixed Account. American National and its agents do not make any recommendations regarding the selection of indexed strategies. American National and its agents do not guarantee the performance of any indexed strategies.

Point-to-Point With Cap

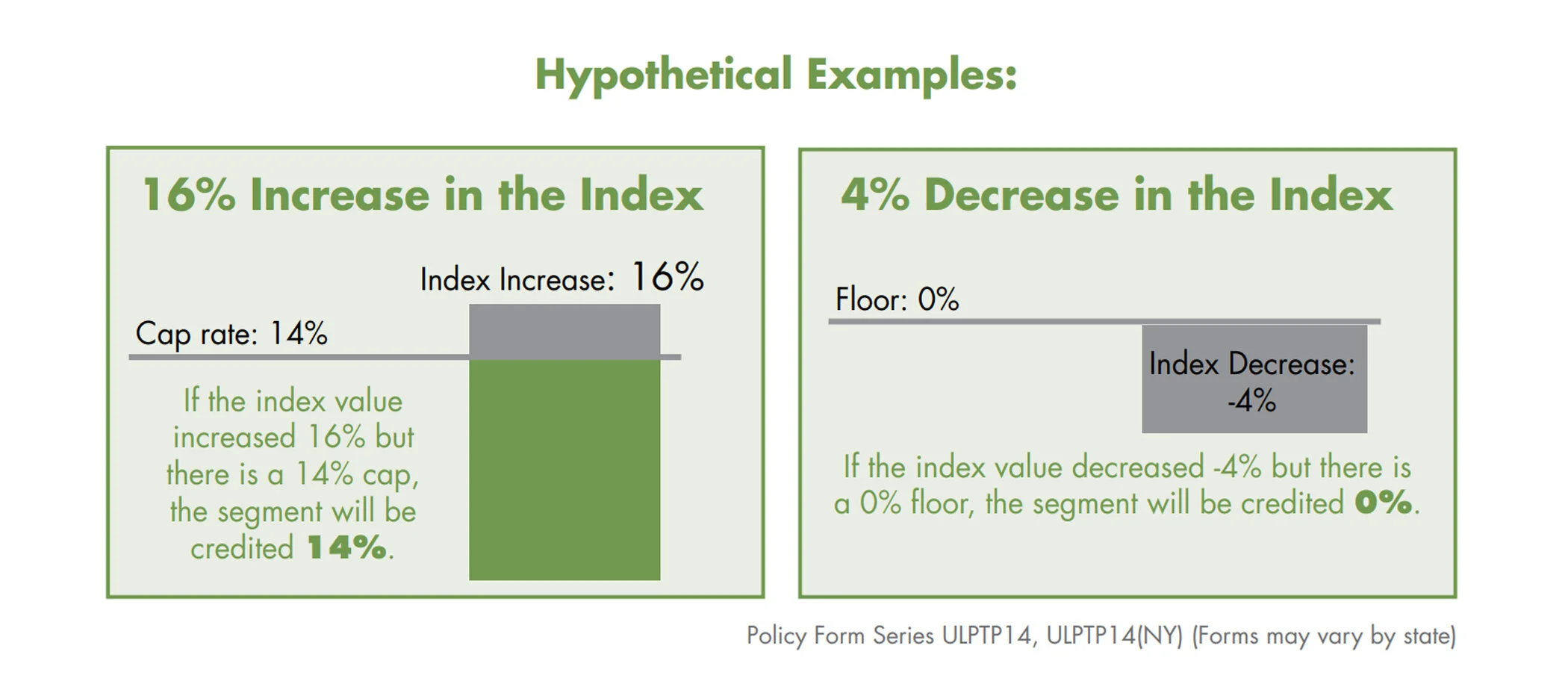

This strategy compares the value of the S&P 500® Index at the beginning of the one year Segment Term to the value at the end of the one year period and measures the percentage of increase or decrease.

• The Participation Rate for this strategy is 100%.

• If there is an increase in the value of the index, the value in this segment will be credited interest using the percentage of increase of the index, up to the Cap set at the beginning of the Segment Term.

• If there is no change or a decrease in the value of the index, the value in this segment will be protected by the 0% floor and will receive no interest earnings.

The use of alternative assumptions in these examples could produce significantly different results. These hypothetical examples are intended solely for illustrative purposes and are not an indication of past or future performance of the Signature IUL product. The published S&P 500® Index does not reflect dividends paid on the stocks underlying the Index.

Point-to-Point With Cap And Higher Floor

This strategy compares the value of the S&P 500® Index at the beginning of the one year Segment Term to the value at the end of the one year period and measures the percentage of increase or decrease.

• The Participation Rate for this strategy is 100%.

• At the end of the year, if there is no change or a decrease in the value of the index, the value in this segment will be credited interest earnings rate using the declared floor for that segment, declared at the beginning of the Segment Term.

• If there is an increase in the value of the index, the value in this strategy will be credited interest using the percentage of increase of the index, up to the Cap set at the beginning of the Segment Term.

Point-to-Point Uncapped with Interest Rate Spread

This strategy also compares the value of the S&P 500® Index at the beginning of the one year Segment Term to the value at the end of the one year Segment Term and measures the percentage of increase or decrease.

• The Participation Rate is 100% with a 0% floor.

• There is no Cap on the potential interest earnings, however, an interest rate spread is deducted from the interest earnings in exchange for the benefit of not having a cap on potential interest. (maximum interest rate spread: 20%)

• The interest spread will reduce the amount of interest credited to the segment by a percentage specified at the beginning of the one year Segment Term.

The use of alternative assumptions in these examples could produce significantly different results. These hypothetical examples are intended solely for illustrative purposes and are not an indication of past or future performance of the Signature IUL product. The published S&P 500® Index does not reflect dividends paid on the stocks underlying the Index.

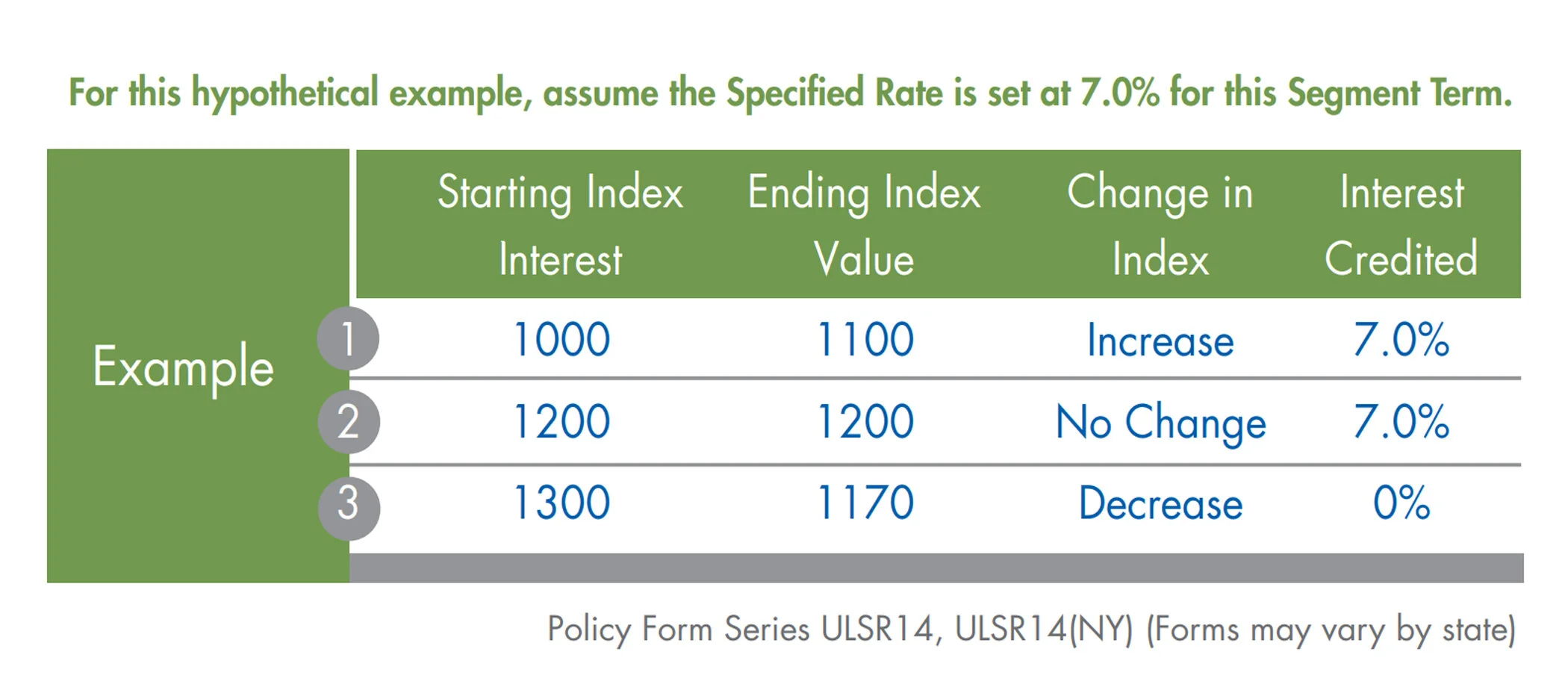

Point-to-Point With Specified Rate

This strategy also compares the value of the S&P 500® Index at the beginning of the one year Segment Term to the value at the end of the one year Segment Term.

• A rate of interest is set at the beginning of the Segment Term.

• If the value of the index increases or remains the same, the strategy will be credited interest at the specified interest rate.

• If the value of the index decreases, the strategy will receive no interest earning

Hypothetical Indexed Crediting

The chart below illustrates the actual historical movement of the S&P 500® Index beginning in 1991 broken down into one-year segment terms beginning January 1st of each calendar year. Using the Indexed Strategies described above, you can get a hypothetical idea for how each segment would have been credited interest had the product existed and premium been allocated to the indexing strategies during the segment terms.

Rates are not guaranteed and are likely to fluctuate; the use of alternate rate assumption would produce significantly different results. Although this product was not available for the period of time referenced above, actual historical values of the S&P 500® have been used. Past performance of the index is no guarantee of future results.

Cumulative Interest Guarantee:

At full surrender or insured’s death, the Accumulation Value will not be less than if all net premiums had been allocated to the Fixed Account with 2.5% interest credited throughout the life of the policy.

Surrender Charges

If you choose to cancel your policy in the first ten years, surrender charges apply.

Flexible Loan Options for Unexpected Financial Needs

Should there be an unexpected financial need, the Policy Surrender Value may be borrowed against at a competitive rate. Signature Indexed Universal Life offers both Fixed and Variable Loan Options. At times, the economic environment may be more conducive to one loan option than the other. The policy includes the option to switch between the Fixed and Variable Loan options once a policy year with a maximum of five switches allowed over the lifetime of the policy. If multiple loans are taken on a policy, all loans must use the same loan option. Policy Loans are subject to interest charges and can reduce the death benefit paid to beneficiaries. While loans need not be repaid, outstanding loans may affect the policy’s death benefit, the value of the policy and possibly the length of time the policy remains in force.

CUSTOMIZED CHOICES

There are a variety of riders available in order to custom design coverage under the Signature IUL policy:

• Accelerated Benefit Riders for Critical, Chronic and Terminal Illness: Allows a partial or full Death Benefit to be accelerated in the event of a qualifying condition. The payment is an unrestricted cash benefit that can be used for any purpose. Critical Illness Rider is not available in New York. Policy Form Series: ABR14-TM; ABR14-CT; ABR14-CH; ABR14-TM(NY); ABR14-CH(NY).

• ANICO Signature Term Rider: Allows you to purchase an amount of additional Term insurance on the insured, a family member or an associate so long as the owner has an insurable interest. The Rider can be added for 10, 15 or 20 years. Policy Form Series ULLTR13; ULLTR13(NY) (Not Available on Signature IUL Unisex

• Disability Waiver of Minimum Premium: Will credit the Minimum Premium amount to the Policy’s Accumulation Value on a monthly basis, due after “Total Disability” begins and while it continues. Policy Form Series ULDW91: ULDW10(NY)

• Disability Waiver of Stipulated Premium: Will credit the Stipulated Premium amount to the Policy’s Accumulation Value on a monthly basis, due after “Total Disability” begins and while it continues. Policy Form Series PWSTP; PWSTP10(NY)

• Children’s Level Term Rider: Provides level term insurance on each Insured Child to the Insured Child’s attained age of 25 or the policy anniversary immediately following the Insured’s attained age of 65, whichever comes first. Policy Form Series ULCTR91; ULCTR14(NY) (Not Available on Signature IUL Unisex

• Guaranteed Increase Option Rider: Provides the right to increase the specified face amount on the base Universal Life policy, without evidence of insurability, on each major life event. Policy Form Series ULGIO14; ULGIO14(NY) (Not Available on Signature IUL Unisex)

• Overloan Protection Rider: Can keep a policy with a large amount of debt from lapsing (some restrictions apply). Policy Form Series ULOPR14; ULOPR14(NY)

Additional information on all these Riders can be found in the Benefits and Riders Guide, Form 10695. Forms may vary by state. Restrictions and Limitations may apply. Not all Riders are available in all states, and there may be additional cost for the Riders.

Important Considerations:

This brochure contains only a general description of the product and is not a policy of insurance. Any coverage is subject to the terms and conditions of the policy itself. For full details see the policy. Expenses, cost of insurance, and interest credited are all explained in your policy. In addition, you will receive a detailed annual report showing all the transactions which occurred in your policy during the year, including the beginning Accumulation Value, premiums paid, expense charges, cost of insurance deducted, interest credited, any loans taken during the policy year, and the ending balance. The Signature Indexed Universal Life Insurance policy is not a registered security or stock market investment and does not directly participate in any stock or equity investments or index. When you buy this policy, you are not buying an ownership interest in any stock or index. American National and its agents do not make any recommendations regarding the selection of indexed strategies. American National and its agents do not guarantee the performance of any indexed strategies. There is not one particular interest crediting strategy that will deliver the most interest under all economic conditions. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by American National Insurance Company and American National Life Insurance Company of New York. S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by American National. American National’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index. Proceeds from life insurance paid because of the death of the insured are generally excludable from the beneficiary’s gross income for tax purposes. (IRC 101(a)(1) ) Your should consult your tax advisor or attorney regarding your specific situation. Only through a general review of your specific situation can it be determined if there are tax advantages available to you through American National’s products, one of which is life insurance. Neither American National nor its representatives provide legal or tax advice. Please consult your attorney or tax advisor regarding specific circumstances. Policy Form Series: IUL14, IUL14(NY), IUL14 (unisex) (Forms May Vary by State)

Accelerated Benefit Rider Notice:

Have your agent refer to rider forms for a complete list of illnesses and definitions. Some states may limit the definition of terminal illness to conditions that are expected to result in death within 12 months. The riders are offered at no additional premium. However, the accelerated payment will be less than the requested death benefit because it will be reduced by an actuarial discount and an administrative fee of up to $500. The amount of the reduction is primarily dependent on American National’s determination of the insured’s life expectancy at the time of election. Outstanding Policy Loans will reduce the amount of the benefit payment. The accelerated death benefit is an unrestricted cash payment. The Chronic and Terminal rider are intended to receive favorable tax treatment under 101(g) of the IRC. Receipt of a benefit could be a taxable event. You should consult a tax advisor regarding the tax status of any benefit paid under these riders. Receipt of Accelerated Benefits may affect your eligibility for Medicaid, supplemental security income, or other governmental benefits or entitlements. Before accelerating any benefit you should consult an advisor to determine the impact on your eligibility. Accelerated Benefit Riders are not replacements for Long Term Care Insurance. This is a life insurance benefit that also gives you the option to accelerate some or all of the death benefit in the event that you meet the criteria for a qualifying event described in the policy. This policy or certificate does not provide long-term care insurance subject to California long-term care insurance law. The policy or certificate is not a California Partnership for Long-Term Care program policy. This policy or certificate is not a Medicare supplement policy. Accelerated benefit riders (“ABR”) and long-term care insurance (“LTCI”) provide different types of benefits. An ABR allows the insured to access a portion of the life insurance policy’s death benefit while living and may be used for any purpose. LTCI provides reimbursement for necessary care received due to the inability to perform activities of daily living or cognitive impairment. Coverage may include reimbursement for the cost of a nursing home, assisted living, home health care, homemaker services, adult day care, hospice services or respite care for the primary caretaker. The benefits may be conditioned on certain requirements or meeting an elimination period or limited by type of service, the number of days or a maximum dollar limit. Benefits under some ABRs and all LTCI are conditioned upon the insured not being able to perform two or more of the activities of daily living or being cognitively impaired. California: See form 10741-CM for a more detailed comparison of benefits provided by an ABR and LTCI.

New York Chronic Illness Rider: This product is a life insurance policy that accelerates the death benefit of account of chronic illness and is not a health insurance policy providing long term care insurance subject to the minimum requirements of New York Law, does not qualify for the New York State Long Term Care Partnership program, and is not a Medicare supplement policy